Financial Training That Fits Your Business Reality

Most businesses struggle with money management not because they lack ambition, but because traditional finance education doesn't address the actual challenges they face. We've spent years working directly with Australian businesses, and we've designed training around what actually works when you're juggling payroll, cash flow, and growth decisions.

Built Around Real Business Constraints

Your team doesn't have time for theoretical frameworks. They need practical skills they can apply immediately — understanding milestone planning, reading cash flow projections, making informed decisions about expansion timing.

Our programs run during work hours or in flexible evening slots. Sessions typically span three to six months, starting September 2025 or February 2026. We work around your operational calendar because we know shutting down for training isn't realistic.

What makes this different? We bring in actual business scenarios. Your team works through case studies based on companies similar to yours, facing challenges they'll recognize from their own experience.

Explore Program Structure

Core Capabilities We Develop

Milestone Recognition

Teaching teams to identify critical financial thresholds before they become urgent problems. This includes spotting when cash reserves dip below safety margins or when growth is outpacing operational capacity.

Resource Allocation

Making smart decisions about where money goes. Your managers learn to evaluate investment opportunities, prioritize spending, and understand opportunity costs in practical terms.

Risk Assessment

Building intuition around financial exposure. Participants develop frameworks for evaluating new ventures, understanding market volatility, and maintaining appropriate buffers.

Projection Development

Creating realistic financial forecasts that account for seasonality, market conditions, and business cycles. We focus on practical modeling techniques that don't require advanced degrees.

Communication Skills

Translating financial concepts for different stakeholders. Your team learns to present budget proposals, explain variances, and discuss financial performance with confidence.

Crisis Navigation

Preparing for unexpected financial challenges. We work through scenarios involving sudden revenue drops, emergency expenses, and market disruptions so teams have mental frameworks ready.

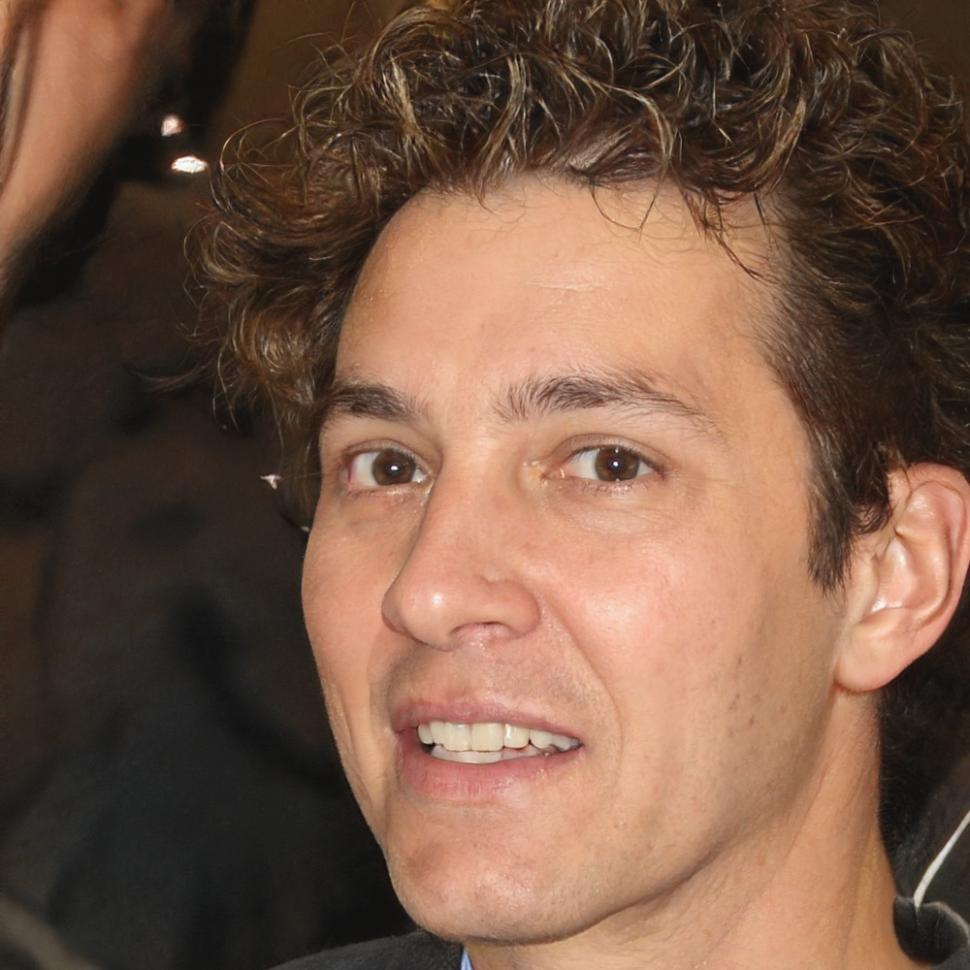

Torben Lindqvist, Program Lead

I've watched too many talented teams struggle because nobody taught them the financial basics they actually need. We designed this training after working with 70+ Australian businesses and identifying the specific gaps that cause problems. It's about building confidence and capability in the people already doing the work.

How Teams Transform Their Financial Approach

We've seen businesses shift from reactive scrambling to proactive planning. Here's what that progression typically looks like when teams engage seriously with the material.

Before: Operating in Crisis Mode

Most teams come to us when they're tired of constant financial surprises. They're making decisions based on current bank balances rather than strategic planning.

Managers avoid budget conversations because they lack confidence in the numbers. Financial reports gather dust because nobody knows how to extract actionable insights.

There's tension between departments over resource allocation, and growth opportunities get missed because nobody can model the financial implications quickly enough.

After: Strategic Financial Management

Teams develop the capability to spot financial patterns early. They're having productive conversations about resource allocation backed by solid projections.

Managers feel comfortable presenting budget proposals and can defend their numbers. Financial reports become tools for decision-making rather than compliance exercises.

The business can model different scenarios before committing resources. People understand trade-offs and can participate meaningfully in strategic discussions about growth, investment, and risk.

Practical Implementation That Respects Your Schedule

We know you can't pull your entire team out of operations for weeks. Programs typically involve half-day workshops spread across several months, with between-session assignments that apply directly to your business.

Participants work on their own company's financial scenarios, so time spent learning doubles as productive work on actual business challenges. You're not paying for theoretical exercises.

Groups stay small — usually six to twelve people from similar-sized businesses. This creates space for real discussion and peer learning. Your team members meet other professionals facing comparable challenges, which often proves as valuable as the formal content.

We offer both in-person sessions at our Tuggeranong center and hybrid formats for teams with remote members. Content adjusts based on your industry and business model. A retail operation has different needs than a professional services firm, and we account for that.

Most businesses see participants applying concepts within weeks. The goal isn't certification — it's capability. We measure success by whether your team makes better financial decisions six months after the program than they did before.

Enrollment for autumn 2025 programs opens in June. Early 2026 cohorts begin taking applications in October. We cap groups deliberately to maintain quality, so spaces fill several months before start dates.

Get Specific Information

Reach out to discuss your team's specific challenges. We'll talk through whether our approach matches what you need and share detailed program structures relevant to your business type.